Discuss about Allintitle:when does amazon stop accepting venmo, Choose the best payment methods for your store! Discover tips to enhance security, improve user experience, and reduce fees

Allintitle:when does amazon stop accepting venmo

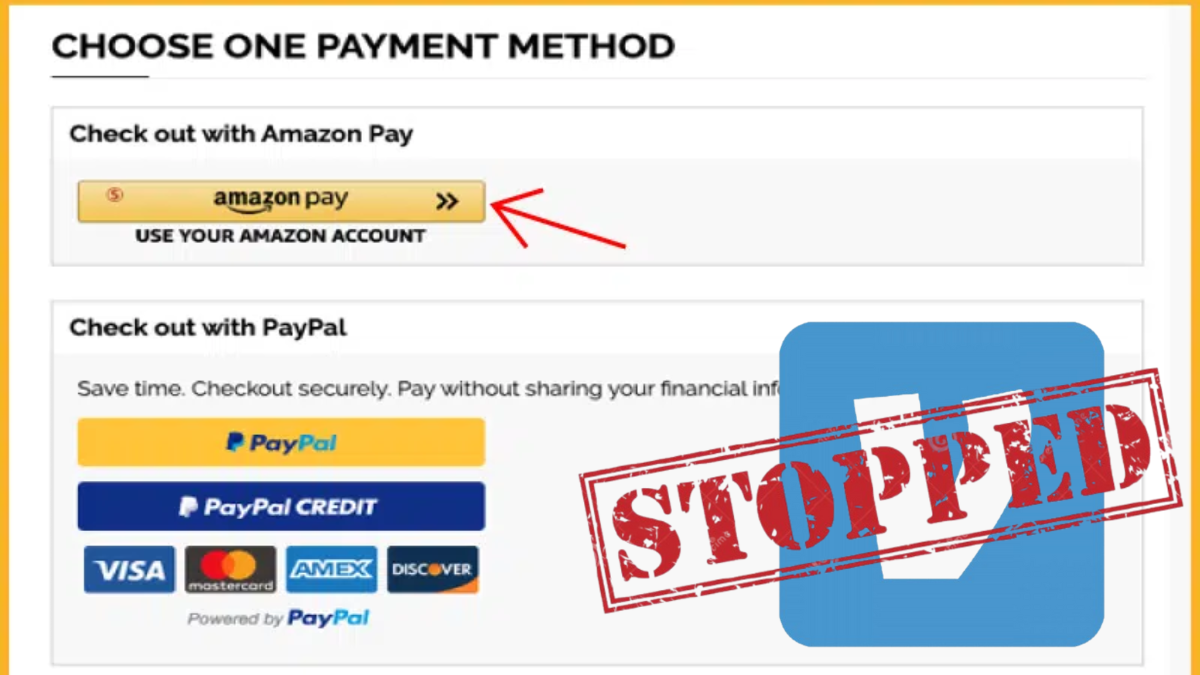

Amazon will stop accepting Venmo as a payment option starting January 10, 2024. However, you can still use Venmo debit and credit cards on Amazon

Why is Amazon discontinuing Venmo acceptance?

Amazon hasn’t provided a specific purpose for discontinuing Venmo as a payment approach. However, there are some speculations:

- Security Concerns: Some consider that Venmo wasn’t considered a secure enough price platform for larger transactions.

- Scam Prevention: There have been worries about ability scams the use of Venmo.

- Strategic Reasons: Amazon is probably making plans to sell its own payment services or other price strategies.

While Venmo itself hasn’t been accepted, Venmo debit and credit cards can still be used on Amazon

What are alternative payment methods on Amazon now?

Amazon offers quite a few alternative price methods to make your buying revel in greater convenient. Here are a few options:

- Amazon Pay: You can use the fee instruments saved on your Amazon account to pay for goods and offerings on third-celebration web sites and apps that receive Amazon Pay.

- Credit and Debit Cards: Amazon accepts essential credit and debit playing cards, along with Visa, MasterCard, American Express, and Discover.

- Amazon Store Card and Prime Store Card: These playing cards offer unique financing alternatives and rewards for Amazon purchases.

- Buy Now, Pay Later: Services like Affirm let you split your buy into monthly installments.

- Citi Flex Pay: This alternative offers equal month-to-month charge plans for eligible purchases.

Local Payment Methods: Depending on your area, you may have get entry to to local payment alternatives through partnerships with neighborhood economic establishments

How do these methods compare with other e-commerce sites?

Let’s compare Amazon’s payment methods with those offered by other popular e-commerce sites:

| Payment Method | Amazon | PayPal | Stripe | Shopify | eBay |

|---|---|---|---|---|---|

| Amazon Pay | Yes | No | No | Yes | Yes |

| Credit/Debit Cards | Yes | Yes | Yes | Yes | Yes |

| Buy Now, Pay Later | Yes | Yes | Yes | Yes | Yes |

| Store Cards | Yes | No | No | Yes | No |

| Local Payment Methods | Yes | Yes | Yes | Yes | Yes |

| Cryptocurrency | No | Yes | Yes | Yes | No |

Key Differences:

- Amazon Pay: Offers a streamlined checkout experience, allowing users to pay without leaving the site.

- PayPal: Widely accepted and supports transactions in over 200 countries. It also offers buyer protection.

- Stripe: Known for its flexibility and customization options, ideal for developers.

- Shopify: Provides a comprehensive suite of payment options, including support for cryptocurrencies.

- eBay: Similar to Amazon, but also supports cryptocurrency payments.

Each platform has its strengths, so the best choice depends on your specific needs and preferences.

What should I consider when choosing a payment method for my store?

Choosing the proper charge method on your store is crucial for ensuring smooth transactions and client pleasure. Here are some key elements to don’t forget:

Customer Preferences:

- Offer fee techniques that your clients pick and are familiar with.

- Consider neighborhood charge options when you have an international customer base.

Security:

- Ensure the fee technique complies with industry security requirements (e.G., PCI DSS).

- Look for functions like fraud detection and encryption.

Fees:

- Evaluate transaction expenses, setup fees, and month-to-month fees.

- Consider how these prices will impact your income margins.

Ease of Integration:

- Choose a charge approach that effortlessly integrates together with your website or e-trade platform.

- Look for APIs and plugins that simplify the mixing procedure.

Support and Reliability:

- Ensure the payment company offers reliable customer support.

- Check for uptime ensures and reliability metrics.

Speed of Transactions:

- Consider the time it takes for transactions to be processed.

- Look at agreement instances for funds to be transferred on your account.

User Experience:

- Provide a unbroken and intuitive checkout process.

- Reduce friction in the fee system to decrease cart abandonment.

Scalability:

- Choose a price method which can scale along with your enterprise as it grows.

- Look for capabilities that accommodate higher transaction volumes and new markets.

Here’s a quick comparison table to help you weigh these factors:

| Factor | Key Consideration |

|---|---|

| Customer Preferences | Local payment options, familiarity |

| Security | PCI DSS compliance, fraud detection |

| Fees | Transaction, setup, and monthly fees |

| Ease of Integration | APIs, plugins, compatibility |

| Support and Reliability | Customer support, uptime guarantees |

| Speed of Transactions | Transaction processing and settlement |

| User Experience | Seamless checkout, minimal friction |

| Scalability | Accommodate growth and new markets |

By carefully considering these factors, you can choose the best payment methods to enhance your store’s overall performance and customer satisfaction.

Conclusion

Choosing the right payment method for your store is vital for ensuring secure, efficient, and customer-friendly transactions. By considering customer preferences, security, fees, ease of integration, support and reliability, speed of transactions, user experience, and scalability, you can select the best payment options for your business. This will not only enhance your store’s performance but also improve overall customer satisfaction.

FAQs

What are the most popular payment methods for e-commerce stores?

The most popular payment methods for e-commerce stores include credit and debit cards, PayPal, Amazon Pay, Buy Now, Pay Later services (e.g., Affirm), and local payment methods.

How do I ensure that my chosen payment method is secure?

Ensure that the payment method complies with industry security standards like PCI DSS, offers fraud detection, and uses encryption to protect sensitive information.

What fees should I consider when choosing a payment method?

Evaluate transaction fees, setup fees, and monthly fees. Consider how these fees will impact your profit margins and choose a payment provider that offers competitive rates.

How do I integrate a payment method with my e-commerce platform?

Look for payment providers that offer APIs, plugins, and easy compatibility with your e-commerce platform. This simplifies the integration process and ensures smooth transactions.

What should I consider regarding the speed of transactions?

Consider the time it takes for transactions to be processed and the settlement times for funds to be transferred to your account. Faster processing times improve cash flow and customer satisfaction.

How can I provide a seamless user experience during the checkout process?

Offer a variety of payment options, ensure a simple and intuitive checkout process, and reduce friction by minimizing the steps required to complete a purchase.

What is the importance of scalability in payment methods?

Scalability is important to accommodate business growth and higher transaction volumes. Choose a payment provider that can support your business as it expands and enters new markets.